how to lower property taxes in california

File for a Homestead Exemption or Credit. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year.

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Option 1 Appeal The Taxable Value.

. So if your property is assessed at 300000 and. The share of homeowners over 65 increased from 24 percent in 2005 to 31 percent in 2015. 8 appeal unlike a base year value appeal contests the value for a particular tax year only.

For married couples only one spouse must be 55 or older. Avoid renovations or improvements. If the tax rate is 1 they will owe 9000 in property tax.

California Property Tax Rates. Although each county has its own method property taxes are generally. Up to 25 cash back Bonnie and Clyde live in San Francisco County.

Mooney Blvd Room 102-E Visalia CA 93291. Number of Inherited Properties Likely to Grow. Low-income residents earning less than 13200 annually.

In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area. The resulting value can be increased by the Assessor in any. Monday to Friday Excluding Holidays Telephone 916 875-0700 8 am.

Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county clerk or online. Some counties charge a 30 to 60 filing fee. When Proposition 19 was voted into law in Nov 2020 taking affect in Feb of 2021 a learning curve was suddenly in effect for new homeowners and beneficiaries inheriting property from parents.

Chances are the city has already sent you a property assessment letter before the. Seniors 62 or older Blind and disabled citizens. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it.

Assistance for the hearing impaired is available by calling 711 for California Relay Service. ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952 Office Hours 8 am. The median annual property tax payment in Fresno County is 1948 more than 2000 below the state median.

Its important you proactively find out what the citycounty is assessing your property for first before you prepare for battle. Each county collects a general property tax equal to 1 of assessed value. How Do I Reduce My Property Taxes.

FREE shipping on qualifying offers. Mint Images - Bill MilesGetty Images. Any additions renovations or improvements to your home will be noticed by the county assessor and may increase your propertys assessed value.

Send the application to your assessors office with a return receipt requested. 8 appeal by 915 of each tax year. California property owners are getting older.

Main Contact Contact Info 559 636-5100 Phone 559 737-4468 Fax. In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area. All but a handful of states allow you to claim your primary residence as a homestead which offers you protection from creditors and exempts you from paying a portion of your property tax bill say the first 50000 of its assessed value.

The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 49017 or. Option 1 Appeal The Taxable Value. Candidates should apply for the program every year.

Steps to Appeal Your California Property Tax. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. The exemption applies to a portion of the assessed amount the first 34000.

Simple tips to make your property tax bill as fair and manageable as possible are. The San Francisco County Assessor placed a taxable value of 900000 on their home. New 2021 Rules for Transferring Property Taxes In California.

Property taxes paid in terms of dollars spent are far lower. 1 Google assessors office. Applicants must file claims annually with the state Franchise Tax Board FTB.

The caveat here is the market value of the new house generally must be lower or equal to the home being sold. It became essential especially for middle class and upper middle class families to. Aid is a specified percentage of the tax on the first 34000 of property assessment.

The easiest but most commonly overlooked action is the filing of a Prop. The state reimburses a part of the property taxes to eligible individuals. How to Reduce Your California Residential Property Taxes.

For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level.

There are however a few ways homeowners can reduce their California property taxes. Property taxes in California are applied to assessed values. If Bonnie and Clyde successfully appeal and the county appeals board reduces that value to 850000 the savings will be significant.

Although each county has its own method property taxes are generally. There are however a few ways homeowners can reduce their California property taxes. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Property Taxes By State Embrace Higher Property Taxes

Payment Activity Notice Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

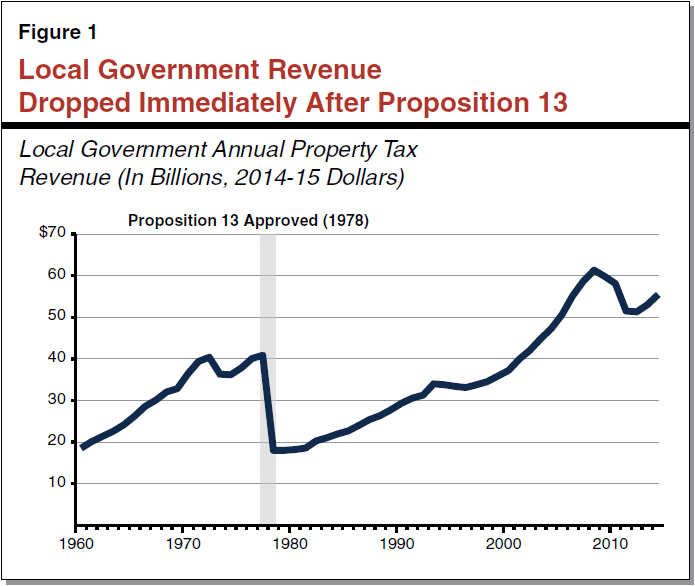

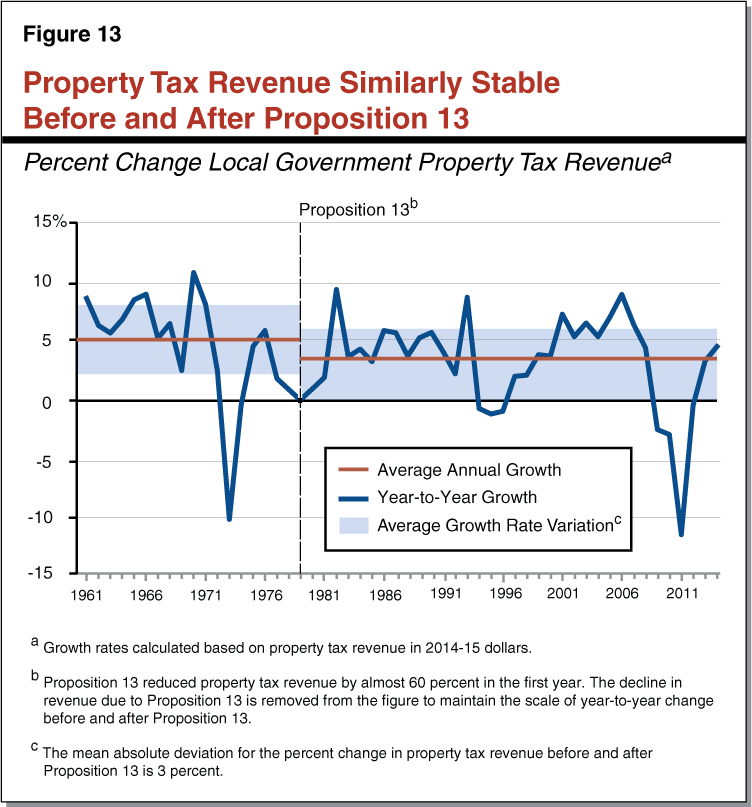

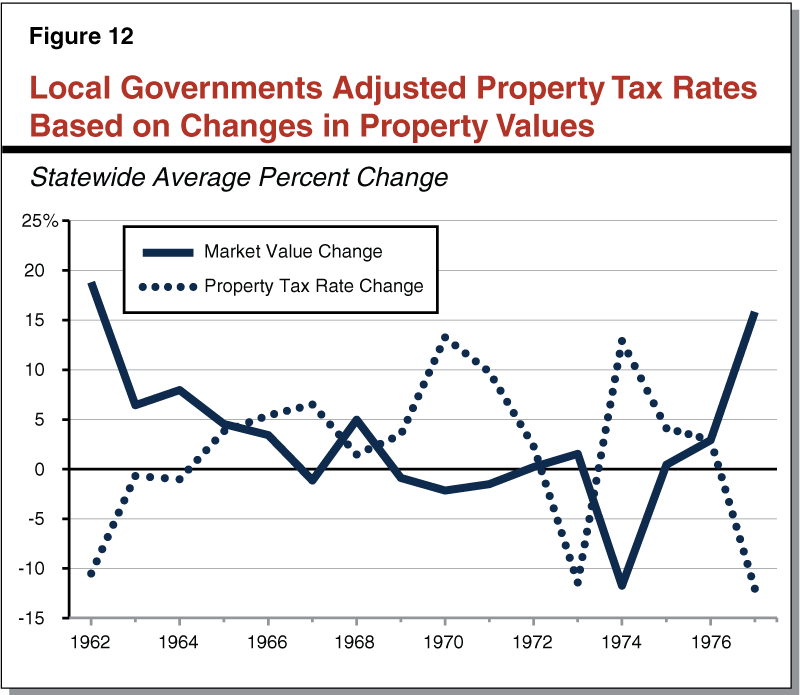

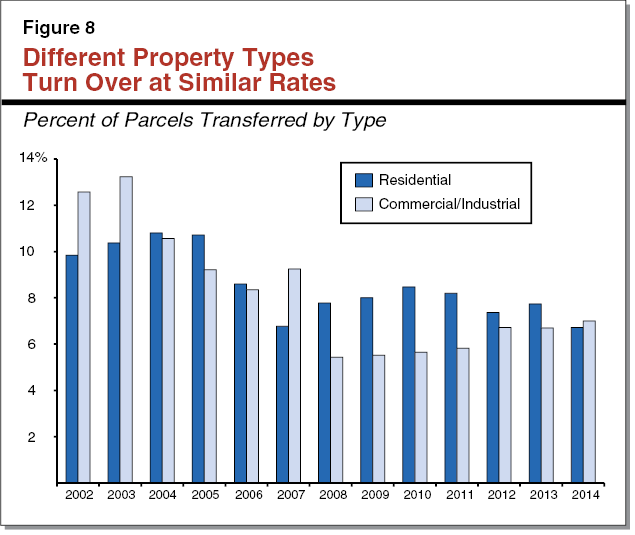

Common Claims About Proposition 13

Common Claims About Proposition 13

Proposition 19 Property Tax Reassessment Exemptions For 2021

Deducting Property Taxes H R Block

Common Claims About Proposition 13

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Property Tax Process Mendocino County Ca

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Taxes By State Embrace Higher Property Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree

The Property Tax Inheritance Exclusion

Common Claims About Proposition 13

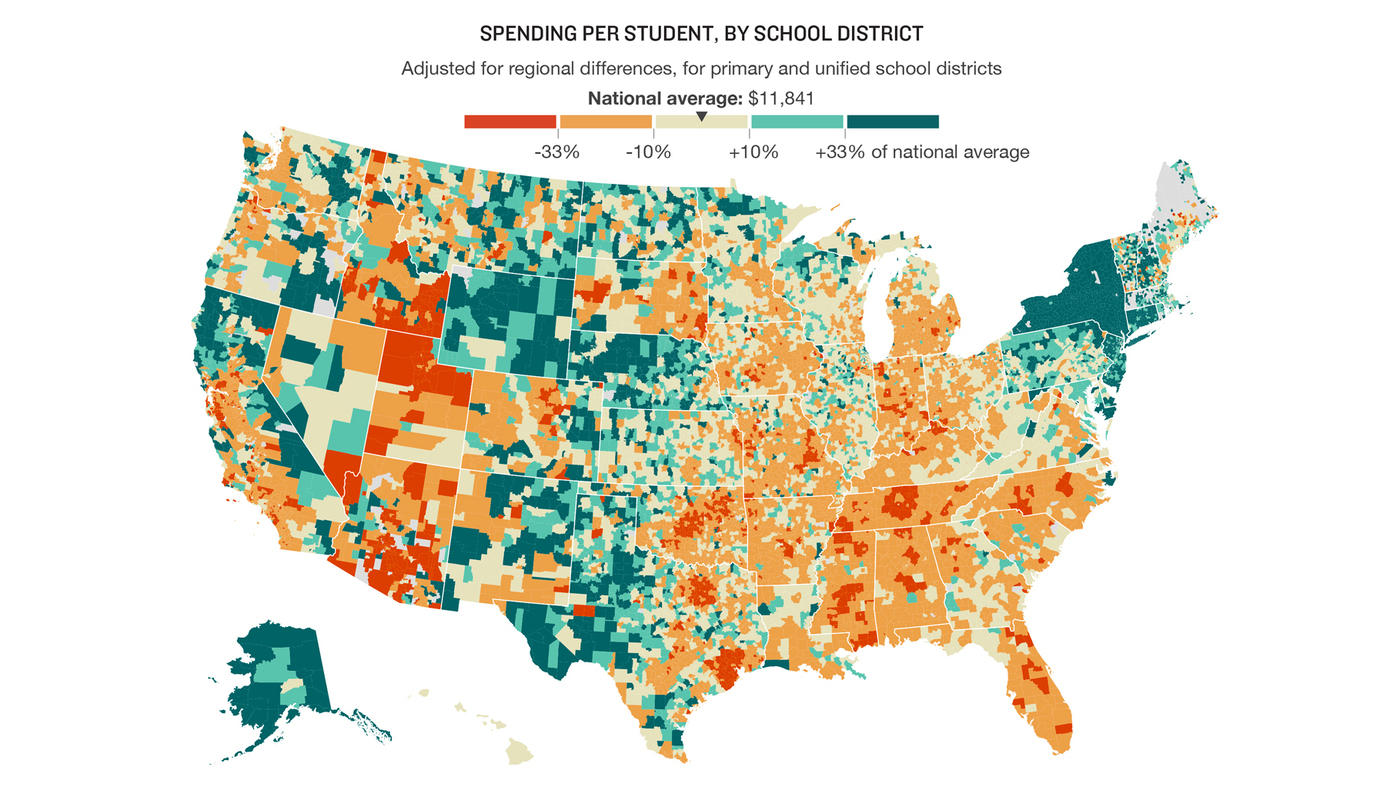

How School Funding S Reliance On Property Taxes Fails Children Npr