tax deferred exchange definition

Like-kind property When two properties belong to the same category or type theyre called like-kind. Investors who are in escrow need to reinvest to defer large tax consequences a process called a 1031 tax deferred exchange.

6 Steps To Understanding 1031 Exchange Rules Stessa

Those taxes could run as high as 15 to 30 when state and federal taxes are combined.

. Handling earnest money deposits in a 1031 Exchange. The QI creates legal distance between you and your 1031 transactions by. A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain.

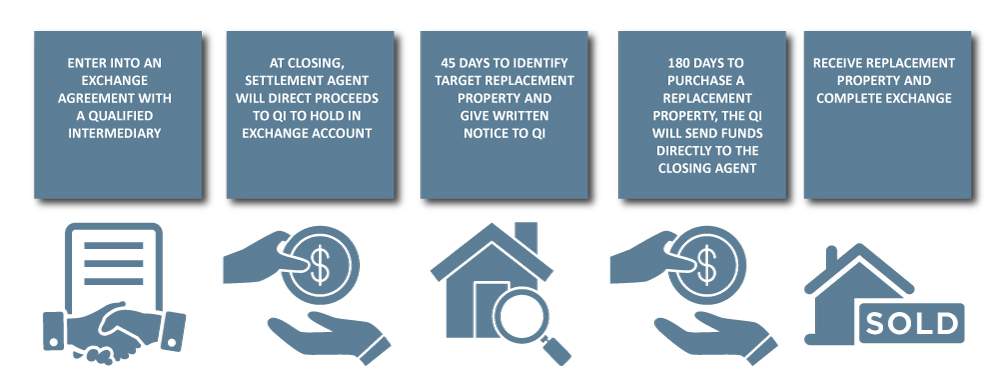

More What Is a Reverse Exchange. Not taxable until a future date or event as withdrawal or retirement. The deferred 1031 exchange gives you time by allowing you to sell your first property to an intermediary who then buys the property on the other end of the exchange at a later date.

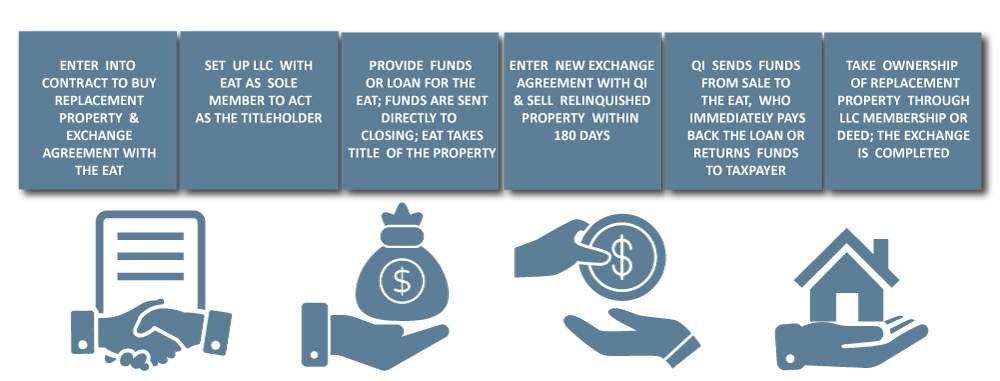

A reverse exchange Refers to method of executing a tax-deferred exchange aka 1031 exchange or like-kind exchange in which the exchanger or taxpayer acquires the replacement property before selling the property to be relinquished. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. In the investment world tax deferred refers to investments on which applicable taxes typically income taxes and capital gains taxes are paid at a future date instead of in the period in which they are incurred.

This property exchange takes its name from Section 1031 of the Internal Revenue Code. The formal rules for a QI are defined in Treas. In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange.

Deferred tax asset is recognised also for the carryforward of unused tax losses and unused tax credits IAS 1234. Tax deferred is an instance where investment earnings such as interest dividends or capital gains accumulate tax-free until the payment of taxes related to the investment is triggered by some taxable event in the future. As with other deferred tax assets availability of future taxable profit criterion applies.

A tax-deferred exchange in which one asset is exchanged for a similar asset of the same nature character or class. For example consider the traditional Individual Retirement Account IRA. 1031 Tax-Deferred Exchange Definition For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for doing so.

How Does Tax Deferred Work. The Legal Information Institute wrote a solid technical answer. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

The gain may be taxable in the current year. What is Tax Deferred. Because of the short timeframe required for investing the profits one of the most important tactics in executing a successful 1031 Exchange is to have a solid real estate deal to roll in the profits.

If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. Specifics of a Deferred 1031 Exchange.

Tax-deferred status refers to investment earningssuch as interest dividends or capital gainsthat accumulate tax-free until the investor takes constructive receipt of the profits. The tax-deferred definition in tax-deferred accounts means that you have an option to have tax deductions delayed on your contributions full amount. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

The termwhich gets its name from Internal Revenue Code IRC. Legal Definition of tax-deferred. Be sure to consider that not all IRAs are subject to tax deferrals.

This keeps the entire series of actions as one transaction which makes it eligible for a 1031 exchange albeit a deferred one. A Qualified Intermediary QI helps taxpayers facilitate tax-deferred exchanges under Internal Revenue Code 1031. Paragraph IAS 1235 specifically emphasises that the existence of unused tax losses is strong evidence that future taxable profit may not be available and that an entity.

Eddie can acquire the new property. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. And what exactly does that mean.

As an example Eddie Exchanger finds a property that is a great deal but he needs to act quickly to buy it. With the help of a tax-deferred exchange company you can sell one or more property and defer the payment of capital gain taxes by acquiring a replacement property. Sometimes people say tax-free exchange but thats NOT accurate because the tax is only deferred until the day you sell the property and choose not to invest the money into a new one.

Real estate investments may defer certain taxes including capital gains and depreciation recapture via a 1031 exchangeNote that tax deferral does not. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. Deferred 1031 exchanges are.

With tax-exempt accounts you dont have to pay any taxes upon retirement withdrawal. This is a procedure that allows the owner of investment property to sell it and buy like-kind property while deferring capital gains tax. On this page youll find a summary of the key points of the 1031 exchangerules concepts and.

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

Are You Eligible For A 1031 Exchange

Eight Things Real Estate Investors Should Know About Section 1031 Exchange

What Is Boot In A 1031 Exchange Youtube Exchange One Piece Episodes Carrie Anne Moss

1031 Exchange When Selling A Business

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

What Is A 1031 Tax Deferred Exchange Kiplinger

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Asset Preservation Inc

6 Steps To Understanding 1031 Exchange Rules Stessa

International Vs Domestic Finance Project Finance Accounting And Finance Finance

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube